Giving Other People’s Money

By Joseph Duplessis – ZgEyj5EEKdux-g at Google Cultural Institute maximum zoom level, Public Domain, Link

Those who are in favor of a large, centralized government often believe giving other people’s money to charity is to be encouraged. Those who pay taxes do not have a direct voice in how their money is spent, or how inefficiently the government redistributes their hard-earned dollars.

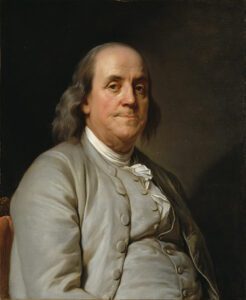

Benjamin Franklin is from my hometown of Philadelphia and did many great and wonderful things as a Founding Father of our country. He wrote an autobiography that has a story concerning the founding of a charity hospital in that city. Many people living in colonial Philadelphia had medical needs that went unmet due to the expense of medical care. A friend of Benjamin Franklin felt the need for establishing a charity hospital that could take care of those people.

Unfortunately, he was unable to obtain sufficient funds to build the hospital through voluntary giving and so he asked Franklin for assistance. Franklin was known then for his ability to fundraise for other causes and accepted the challenge.

Unfortunately, even with the assistance of Franklin’s fundraising acumen, not enough money could be raised for the challenge. Franklin then conceived of a plan; he would go to the Pennsylvania State Assembly and ask for support from taxpayer money. He wrote a bill where the government would pay for part of the building but only if enough private charitable funds could be raised first. This would allow the representatives to “take credit” for building the hospital with private money. The challenge was accepted and the hospital was built. Incidentally, this hospital became known as Pennsylvania Hospital and is where I was born nearly 200 years later.

Politicians Love Giving Other People’s Money

Robert Byrd – By U. S. Senate – http://byrd.senate.gov/newsroom/photos/byrd_formal_smile_highres.jpg, Public Domain, Link

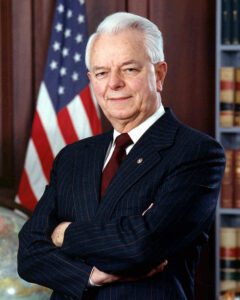

It is no surprise that politicians love to spend other people’s money. The urge to spend becomes even more irresistible when a politician can permanently attach their name to the results of their spending. One of the masters of this self-aggrandizing technique was Senator Robert C. Byrd of West Virginia. He literally has hundreds of monuments, government buildings, and other projects named after him throughout the country but especially in his own state. These include,

- Robert C. Byrd Highway System,

- Robert C. Byrd Bridge,

- Robert C. Byrd Expressway, Robert C. Byrd Federal Building,

- Robert C. Byrd Health and Wellness Center,

- Robert C. Byrd Institute for Advanced Flexible Manufacturing Systems, etc.

Politicians have honed their skills at spending other people’s money and then claiming credit for whatever other people built. This has become (sadly) an expected pattern in American politics and accounts for much of the ill-advised spending in Washington. It seems every politician does not, and they all will vote for each other’s spending initiatives so their own spending will be supported. The art is further honed when this overspending is included in must-pass legislation that the President cannot veto. This ensures the politician will get credit from the electorate for some laudable project by spending other people’s money.

People are also becoming more adept at spending other people’s money as well. A significant number of Americans consider themselves charitable because they support policies of income redistribution through taxation. Unfortunately, their support for spending other people’s money does not extend to spending their own money on charity.

As a general rule, those who support income redistribution as a form of charity give the least amount of their own money to charitable organizations. Amazingly, even if the policies of income redistribution do not actually come into effect, those who originally supported these policies still give very little of their own money to charity. Political opinions become a substitute for their own giving.

Alternatively, those who oppose income redistribution as a means of charitable support give far more of their own money to charity.

Charity Responsibility

Poverty – Image by Sri Harsha Gera from Pixabay

A survey in 1995 helps to provide further clarity on this charitable giving difference. People were asked to respond to the statement, “The government has a responsibility to reduce income inequality.” When asked this question, forty-three percent disagreed while thirty-three percent agreed.

Those who disagreed with the statement gave about four times more money per year to charity, mostly to nonreligious charities as those who agreed. They gave more to every type of charity as well – to health charities, educational associations, international aid, and various human welfare groups. Furthermore, those who disagreed strongly gave about twelve times more to various types of charity than those who strongly agreed with the statement.

This difference continues when the statement is rephrased to get a positive answer; “the government has a basic responsibility to take care of people who can’t take care of themselves.” Seventy-five percent of respondents agreed with that statement, while the rest did not. The twenty-five percent who disagreed were more likely than the other to give to both secular and religious charities.

Maybe those who disagree with the statement are more wealthy and less needful of government charity. Another study tried to control for various biases including income, education, religion, age, gender, marital status, race, and even political views. Even when controlled for all these factors, those who oppose income redistribution are more likely to give to charity.

In other words, those who support income redistribution are privately less charitable to both religious and secular causes than those who do not support it.

Volunteering and Other Charitable Giving

Giving of money is one thing, but maybe those who support income redistribution through taxation and government policies volunteer more – giving more of their spare time – than those who do not support it.

Studies show, however, that those who support income redistribution are less likely to volunteer their free time than those people who do not support it. In fact, the study showed that those who did not support income redistribution were more likely to give directions to people on the street, return extra change to a cashier, or give food or money to a homeless person.

Those who support income redistribution were less likely to give blood than those who supported increased government taxation.

These studies along with multiple others show that government spending on charitable organizations leads people to give less to charity. The evidence suggests that both liberals and conservatives give less to charity when the government takes more in taxation.

The most likely reason for this reduced voluntary giving is that people view government aid and charitable giving as substitutes. Economists have a name for this called the “public goods crowding out effect.” This means government spending has far less effect than might be thought as it substantially reduces charitable giving.

Another downside to the government giving to charities is that it makes that charity more dependent upon government money. When that charity accepts money from Uncle Sam, it will likely receive less charitable private donations. Charities that become more dependent upon government money then can be more easily controlled by the government, as government support seldom comes without obligations.

This might mean, for example, that a charitable hospital that accepts government money has to provide abortions or support embryonic stem cell research even though it may be against their founding principles.

The Political Left and Attitude Concerning Charity

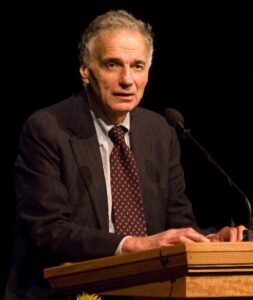

Ralph Nader – By Don LaVange (https://www.flickr.com/photos/wickenden/) – Flickr (https://www.flickr.com/photos/wickenden/474602694/), CC BY-SA 2.0, Link

The American left has developed a resistance to the idea of charitable giving. Perhaps the best example of this resistance can be found in the philosophy of Ralph Nader. He started,

A society that has more justice is a society that needs less charity.

Justice to Nader meant equality of income regardless of how much people contribute to society. Nader was a strong supporter of forced income redistribution as a means for achieving income equality and therefore a just society. To him, any charity was evidence of an unjust society by his definition of “justice.” Americans all prefer the usually accepted definition of justice as being held accountable for misdeeds. But to Nader, the criminal misdeed is simply having more assets than the poorest in society. The mere fact that there were people or institutions that needed charity defined an unjust society.

Nader would likely have agreed with the Marxist philosophy asserts that wealth should be redistributed “from each according to his abilities, to each according to his needs.” But the perception of “need” is always changing.

Psychologists and economists have repeatedly shown that an individual’s perception of “need” is more in-line with a “want.” A need is more defined by what a person sees others around him as having rather than an actual need. We in America are more wealthy than every society in history, yet many in America perceive they have further “needs” in addition to their car, cell phone, a place to live, air conditioning, and cable television.

John Steinbeck was another famous liberal who ranted against charitable giving. He noted,

Perhaps the most overrated virtue in our list of shoddy virtues is that of giving. Giving builds up the ego of the giver, makes him superior and higher and larger than the receiver. Nearly always, giving is a selfish pleasure, and in many cases is a downright destructive and evil thing. One has only to remember some of the selfish financiers who spent two-thirds of their lives clawing a fortune out of the guts of society and the latter third pushing it back.

Steinbeck and others who support this view hold that charity merely reinforces the existing social inequality reducing the receivers to grateful supplicant begging for money. A more virtuous construct would be to have the government forcibly extract goods and services from those who produce more and give it to those who produce less. It would seem the logical outcome of such government intervention would be to disincentivize the producers from producing more.

The fact that this experiment has been performed endless over the past few hundred years with the same results argues against its repeated application. Perhaps the real reason for income redistribution is to purchase the votes from those receiving government largesse – always a larger population than those from whom this largesse is extracted.

Charity and Self Esteem

Liberals assert that the receiving of charity reduces the supplicant to the status of a supplicant beggar and robs them of self-esteem. Presumably, their self-esteem is not hurt through receipt of charity from the government. In order to shift the narrative, the receipt of charity from the government is redefined as “sharing” rather than “charity.” In this construct, everybody gives, and everybody receives thereby eliminating any need for gratitude.

History suggests this worldview of “voluntary” redistribution is counterproductive. As Margaret Thatcher put it, redistribution eventually makes everybody equal – equally poor. Redistribution systems have been tried repeatedly, most notably in Central and Eastern Europe – and failed miserably. Governments ran inefficient redistribution systems that ultimately collapsed under their administrative weight.

History has yet to support the view that society can prosper without voluntary charity; involuntary “charity” always leads to destruction.

But what about “self-esteem” – charity surely leads to poor self-esteem and that surely is a terrible thing to be prevented at all costs. Also, some suggest that charity perpetuates class distinctions.

Some have proposed charity has even a darker purpose; that is, to promote genocide and slavery. For example, a professor and social critic noted,

[T]he rhetoric of virtue has always coexisted with a deep-seated streak of violent repression in America: the physical and cultural genocide against American Indians, the enslavement of Africans, and the conquering of foreign lands. It is not merely that the rhetoric of caring and the roots of philanthropy are inadequate to assist those who need help, but that their very nature is tainted historically with visions of control over inferiors.

The basic Marxist premise is that the rich only give charitably because they can, but charity is inherently corrupt because these resources given are acquired illegitimately. The rich then become self-righteous believing they are doing something good for the poor when actually they are only mollifying the poor masses to keep them from rising up and demanding more from their production.

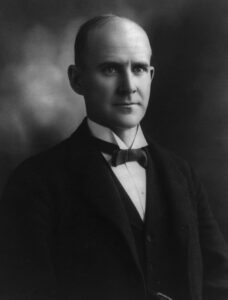

Eugene V. Debs – By Unknown author – This image is available from the United States Library of Congress‘s Prints and Photographs divisionunder the digital ID cph.3a25146.This tag does not indicate the copyright status of the attached work. A normal copyright tag is still required. See Commons:Licensing for more information., Public Domain, Link

Eugene V. Debs who was an early leader of the American Socialist Party admonished the poor not to accept charity from Andrew Carnegie as it represented “blood money.”

These arguments from Debs and other more recent socialists are largely based upon the assumptions that those who give to charity are rich, and that recipients are poor. However, this assumption is wrong. These assumptions are based more on ideology rather than on evidence.

Income Inequality Justifies Giving Away Other People’s Money

Income inequality is a highly important topic to most liberals but also to many conservatives. It is the approach to this income inequality that separates the two political philosophies.

Concern for income inequality is more determined by ideology than by income level. One survey in 2004 shows that upper-income liberals were 22 percent more likely than poor people to say that income inequality was too large. This means that lower-income Americans are less concerned about income inequality than rich liberals.

Bernie Sanders sums up this view well,

There is something fundamentally wrong and very dangerous about a society in which so few have so much and so many have so little.

Liberals believe income inequality is “dangerous” because it is the source of many societal problems including public health and welfare implications. Forcing people with more means to sacrifice some of their monetary excesses can only have a net beneficial effect on society, or so the story goes.

Conservatives have traditionally been concerned about income inequality but in a different way. Conservatives traditionally have been opposed to dependence upon charity or any other type of handouts. Dependency is viewed as denigrating the poor, discouraging work, and actually raising crime rates. Who wants to work if they can receive nearly as much compensation from government charity for the rest of their life? Conservatives would rather promote self-reliance, a good work ethic, and ultimately independence from any charity.

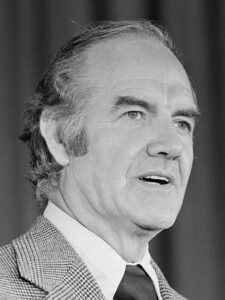

George McGovern – By Leffler, Warren K., photographer. – This image is available from the United States Library of Congress‘s Prints and Photographs division under the digital ID ppmsca.19602.This tag does not indicate the copyright status of the attached work. A normal copyright tag is still required. See Commons:Licensing for more information., Public Domain, Link

It is not only just conservatives that feel this way; many poor people also believe income redistribution is inherently evil. This fact has been particularly befuddling to many liberals but is one of the reasons why the poorest states support conservatives. Many poor people believe that some people work harder than others and that it is unfair to forcibly take it away from them just because they have more than others.

George McGovern found this out the hard way when running for President in 1972. He gave a campaign speech to workers at a rubber factory near Akron, Ohio. In this speech, he promoted a plan to substantially increase inheritance taxes to “level the playing field.” It was promoted as a way to minimize the economic privileges that pass from one generation to the next. To McGovern’s astonishment, he was booed for this plan even though the policy would have benefited many of the workers.

The unpopularity of the “death tax” is still a puzzle to liberal redistributionist politicians. Even though most Americans believe taxes should be increased on the richest, a recent 2015 poll shows that Americans do not support an inheritance tax.

Summary About Giving Other People’s Money

Conservatives give more to charity than liberals by a wide margin. The charity division has been a part of the American landscape for generations.

Conservatives believe charity should be voluntary, and support this philosophy by giving more. Alternatively, liberals believe charity should be mandated by government confiscation of property from richer people to be redistributed to those who make less. Liberals believe giving away other people’s money for social projects is justified by the social good that results from this practice. In other words, the ends justify the means.

The main difference between liberals and conservatives is how the charity is to be given to the poor; either voluntarily or through government confiscation. History has not been kind to those who propose drastically increasing taxes on more productive Americans as they inevitably respond by producing less and shifting their assets to less taxable entities.

Even poor people do not support an inheritance tax as it seems unfair to double tax income and seems inherently unfair to tax away a family’s wealth when the wealth earners pass away.

References

Brooks, Arthur C. Who Really Cares, 2006